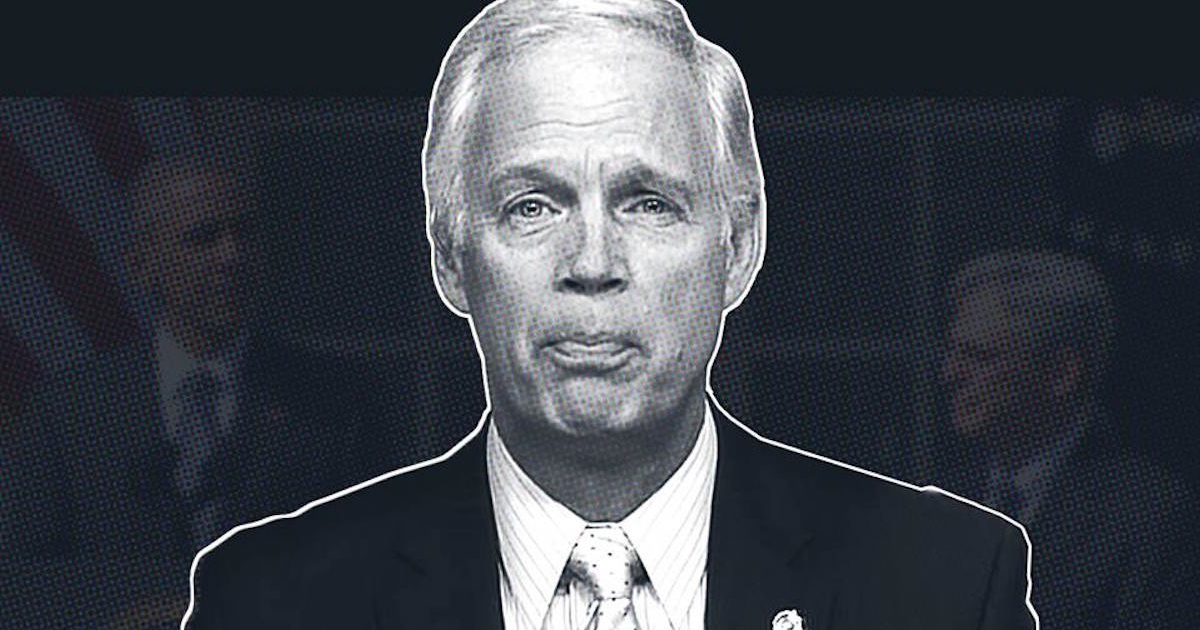

Sen. Ron Johnson Ought to be Apologizing Instead of Bragging About Record on Student Loan Debt

Actions That ‘Stabilized’ Borrowers’ Interest Rates Include Locking Borrowers Into Higher Interest Rates With Votes Against Common Sense Refinancing Plan

MADISON, Wis. — In a media report yesterday, Sen. Ron Johnson’s spokesperson touted how the Senator has “stabilized” student loan interest rates. Unfortunately, Johnson’s multiple votes against allowing student loans to be refinanced just like you can with a mortgage means borrowers in Wisconsin and across the nation are locked into stable, but higher than necessary, interest rates.

“Instead of bragging, Ron Johnson ought to be apologizing for what he’s done to student loan borrowers,” said One Wisconsin Now Executive Director Scot Ross. “He’s stood in the way of common sense refinancing to help millions of borrowers across the nation and in Wisconsin who worked hard to get their education and took on the personal responsibility to pay for it.”

According to statistics from the federal government, 515,000 Wisconsin student loan borrowers could have lowered their interest rates if they were allowed to refinance. Instead, because of Johnson’s votes, a majority of the over 800,000 Wisconsinites owing a collective $19 billion in federal student loan debt continue to pay higher than necessary interest rates.

Johnson’s shockingly out of touch positions on the crisis of college affordability don’t stop with opposing common sense proposals to allow refinancing of federal student loans. He has suggested that the federal government should not be involved in helping students with low interest loans or other means to help fund students’ higher education. Johnson publicly declared that more private for-profit colleges would somehow help resolve a student loan debt crisis that touches over 43 million Americans with over $1.3 trillion in debt.

The multi-millionaire U.S. Senator has also pointed to students themselves as causes of the crises of student loan debt and college affordability, based on his experience in the mid-1970s, when his tuition at the University of Minnesota was 1,700 percent lower than it is today.

Ross concluded, “There is a crisis of student loan debt and college affordability in this country. But far from helping, Sen. Johnson with his words and his actions has shown he is part of the problem.”