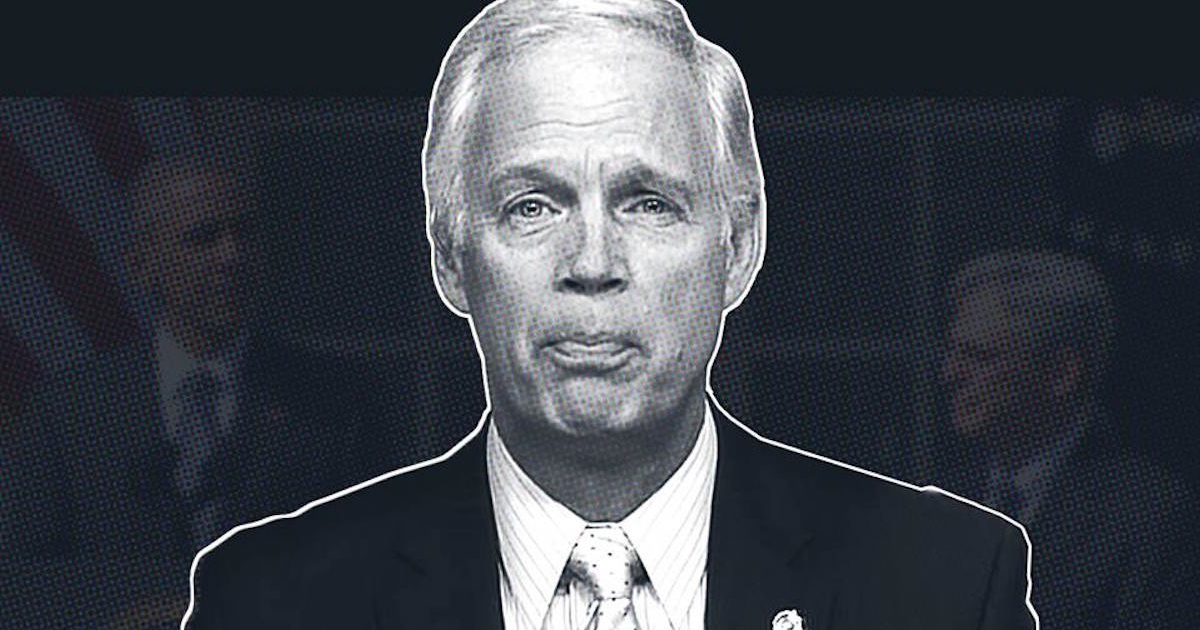

Ron Johnson Says We Should Replace College with Video Tapes

‘Rambling’ Tirade on Higher Education, False Claims Federal Student Loans Eligible for Refinance

“If you wanna teach the Civil War across the country, are you better having tens of thousands of history teachers who kinda know the subject, or would you be better off popping in 14 hours of Ken Burns Civil War tape and have teachers proctor over that excellent tape?” — [U.S. Sen. Ron Johnson at WisPolitics.com Forum, 8/18/2016, minute 31:15 (full interview transcript at bottom of release)]

MADISON, Wis. — In a rambling tirade at yesterday’s WisPolitics.com forum in Milwaukee, U.S. Sen. Ron Johnson (R-WI) attacked the “higher education cartel,” falsely claimed federal student loan borrowers can refinance their loans and called for the replacement of universities and colleges with a private sector certification system and the showing of video “tape.”

“We know Ron Johnson graduated from college 40 years ago, but we assumed it was from a university here on planet Earth,” said Scot Ross, One Wisconsin Now Executive. “Not only does Ron Johnson oppose common sense measures like student loan refinancing that would immediately reduce costs for 515,000 hardworking Wisconsin borrowers, but he apparently thinks the solution to the nation’s higher education student debt crisis is getting rid of diplomas and watching more television.”

“To be fair to Sen. Johnson, a VCR is cheaper than the salary of an educated and trained professor,” Ross added.

One Wisconsin Now has documented how Sen. Ron Johnson has compiled an abysmal record on the student loan debt issue. He has cast multiple votes against allowing student loans to be refinanced just like you can with a mortgage, suggested that the federal government should not be involved in helping students with low interest loans or other means to help fund students’ higher education and publicly declared that more private for-profit colleges would somehow help resolve the crisis.

Johnson has even pointed to students themselves as causes of the crises of student loan debt and college affordability, based on his experience in the mid-1970s, when his $663 tuition at the University of Minnesota was 1,700 percent lower than it is today. In the 1970s, Federal Pell Grants paid 110 percent of the cost of the average public university tuition for a year, but have been woefully underfunded and now only pay 40 percent of that cost. Johnson also fails to acknowledge the reducing in state aid to universities and technical colleges. For instance, since 1990, Wisconsin taxpayer budget spending on higher education has gone from ten cents on the dollar to less than five cents under Gov. Scott Walker.

“It would take fact checkers from now until the Class of 2020 graduates to document all of the provably false statements Ron Johnson offered up in just ten minutes,” said Ross. “What’s more alarming is the bizarro world in which Ron Johnson wants current student loan borrowers and future students to reside, which is exactly the opposite of the debt-free, easy access to affordable higher world he enjoyed in the 1970s.”

During the forum (at minute 29:15) the interviewer, Jeff Mayers, President of WisPolitics.com asks Johnson: “Do you like Russ Feingold?” From there Johnson goes through a 10-minute back and forth, laying out his outlandish ideas, including calling for “disruptive change” in higher education. The transcript follows:

WisPolitics.com: Do you like Russ Feingold?

Ron Johnson: Don’t really know him that well. I’m not very happy with him right now

Wispo: What makes you mad about him?

RoJo: ‘Cause he’s lying and destroying my record. Saying for example that I only want wealthy kids to go to college, nothing could be further from the truth. That I don’t support federal involvement to help underprivileged children go to college. Nothing could be further from the truth. That I wanted no involvement in helping with student loans. I’m the guy that told head of the chairman of health committee to lift his hold on extending the Federal Perkins Loans, because those are incredibly important for higher education. I voted for the Richard Burr-Tom Coburn bill to stabilize interest rates. So he’s taken a couple comments of mine and completely taken them out of context.

Wispo: Let’s talk more about student debt. Should they just be allowed to refinance?

RoJo: First of all, do you think it’s a good thing that our students, our young people are in $1.2 trillion worth of debt? Do you realize that there are currently 38, we just had CRS, Congressional Research Services, document this, 38 different federal programs already on the books that allow individuals to lower their loan payments, their repayments attempts at discretionary that come to make it very possible, a lot of these have loan repayment provisions. So we already have 38 programs, part of the problem we have and one of the reasons we’re mortgaging our children’s future, is because we just keep layering and layering program after program, or another student loan program. We have enough of them.

Wispo: They must not be working then.

RoJo: You know why not? Cause GAO (General Accounting Office) had a study that the Department of Education is not making people aware of them. Seventy percent of students, I can’t remember which year it was, that defaulted on their loans had no idea that there was a program to take advantage of so they wouldn’t have to default.

Wispo: So, the issue about student debt is lack of education on the programs?

AUDIBLE LAUGHTER

RoJo: That’s part of it. We have 38 different programs! So I’ve told people, contact our senate office, we’ll put you in touch with the agency you need to contact to make your payments. By the way, you can always refinance your loan, it’s whether or not you can maintain all the government guarantees within those very favorable loans by the government loans versus a private institution. So you can avail yourself to these programs, as long as you have a government loan, where you can lower your payments to 10 percent discretionary income, where, depending on your occupation, you can actually get forgiveness of your loan after 10 or 20 years. So people don’t want to give up those benefits to refinance in the private sector. One of the reasons you have to subsidize low income individuals strictly if you’re talking about student loan rates, student loan is a high risk loan, it’s not exactly like a mortgage, people always relate them, like “but you can actually refinance a mortgage”, well yeah, you have collateral. A student loan is, a young person has no track record, well some of them have a track record, but there’s certainly no track record to say that this individual can pay off the $30,000 so they’re very high risk loans. But I’ve always thought there’s a better way and I’m not the only one who’s said there’s been some harm created by the federal government involvement. The Federal Bank of New York said that 40 percent of college graduates are in jobs that don’t require a college education or are unemployed. Federal Reserve Bank said: For every dollar the federal government poured into higher education, tuition increases 65 cents and that’s the real problem, that’s the high cost of college. When the federal government started getting involved in the mid-70s, the cost of college has increased at 2.5 times the rate of inflation.

Let’s get rid of the higher education cartel, the stranglehold they have on it, and take a look at why, ask yourself the question, why did college increase their cost. The answer’s pretty easy, the Federal Reserve Bank of New York told you why: the federal government poured money into a market that was limited. There was limited supply, and they dramatically increased the dollar and prices skyrocketed. So what I would suggest, what you have is a higher education cartel and its made of the federal student loan program, federal credit agencies, etc. So, we haven’t even come close to taking advantage of the power of technology when it comes to education. We are still working on the exact same model. To bust up the higher education cartel, we should move to a certification process, not a diploma process because a diploma process maintains that cartel in higher education. A certification process, I’ll use an example, I don’t care how you learn to become an accountant, if you can pass a CPA exam, which is a pretty rigorous exam, you’re a CPA. So, if you wanna do that through online courses or online colleges or just through hard — we got the internet, you have so much info available, why do you have to keep paying differently lectures to teach the same thing, you can have one solid lecture and put it online and have everyone available to that knowledge for a whole lot cheaper? We need to construct a technology for our higher education system.

Wispo: But online education is missing some facets.

RoJo: Of course, it’s a combination, but prior to my doing this crazy thing, I was really involved in an education system in Oshkosh. And one of things we did was the academic excellence system how do you teach more, better, easier. If you wanna teach the Civil War across the country, are you better having tens of thousands of history teachers who kinda know the subject, or would you be better off popping in 14 hours of Ken Burns Civil War tape and have teachers procter over that excellent tape. So you keep duplicating that over all these subject areas, I mean Khan Academy already does that with math. Now I would argue since we have the higher education cartel works really good for college administrators and profs, now I don’t have the info at my fingertips, but you think tenure profs are teaching 40 hours a week?

Wispo: But if you’re running a research program…

RoJo: But, let’s face it, what is causing the increase in college? (Unintelligible) I was an employer, I’d much rather know that someone im hiring is certified in whatever…

Wispo: Well, how would certify something like journalism?

RoJo: Well you’d be one of those guys now that’s either unemployed or you know, in a position that requires no college education at all. I mean it’s not my study, northeaster U and Fed reserve bank came up with those stats.

Wispo: Okay, so you would have a government certification program?

RoJo: Not government, private sector. Trust me the private sector would be very good at this, they already have the CPA program. We need new thinking. We need change, we need disruptive change, disruptive technology and in education. It’s still the brick and mortar process here, even though in the rest of the economy we have got huge production change.

END OF TRANSCRIPT